According to reports, financial firms experienced a 39% increase in cyberattacks in 2023!

In this modern era, where digital transformation is at the forefront of business evolution, the finance industry stands as a pillar of economic stability and growth.

On the other hand, financial institutions are increasingly reliant on technology to manage transactions, investments, and customer data, so cybersecurity has become a critical concern.

Let’s dive deep and understand why implementing a cybersecurity strategy is critical for financial firms, common types of cyberattacks, and how you can protect your enterprise from cyber criminals.

Importance of Cybersecurity in Finance

Cybersecurity in the finance sector is paramount due to the sensitive nature of the data they store and the high stakes involved. Financial institutions handle vast amounts of personal, corporate, and transactional data, making them prime targets for cyberattacks. A breach can led to severe consequences, including financial loss, regulatory penalties, and, more importantly, damage to customer trust.

Moreover, the financial sector needs to follow firm regulatory requirements that mandate the implementation of strong security benchmarks (PCI-DSS). Compliance with these regulations is not only a legal obligation but also essential for maintaining operational integrity and protecting sensitive data.

It’s also good practice to maintain a proactive approach to preventing cyberattacks and staying updated on remediating/mitigating potential threats.

Common Types of Threats in Finance

Understanding the types of threats faced is crucial for developing effective security strategies. Some of the most common cybersecurity threats in the finance sector include:

- Phishing Attacks: Phishing involves malicious emails or messages designed to trick recipients into gathering sensitive information, such as login credentials or financial details. These attacks often appear legitimate, making them particularly dangerous.

- Ransomware: Ransomware is a type of malware that encrypts a victim’s data and demands a ransom payment to restore access. Financial institutions are particularly vulnerable, as the potential of getting and demanding a high ransom has become common.

- Data Breaches: Data breaches involve unauthorized access to sensitive information, often due to weaknesses in security protocols or human error. These breaches can expose personal and financial data, leading to identity theft and financial fraud.

- Insider Threats: Insider threats come from within the organization, whether through malicious intent or negligence. Employees with access to sensitive data can also intentionally compromise security in exchange for their own agenda.

- Distributed Denial of Service (DDoS) Attacks: DDoS attacks overwhelm a network or website with traffic, causing disruptions or shutdowns. In the finance sector, these attacks can hinder access to critical services and damage the institution’s reputation.

Best Practices to Keep Your Enterprise Safe

To remediate risks and strengthen cybersecurity in finance, institutions should adopt a comprehensive approach.

Here are some best practices to consider:

- Implement Multi-Factor Authentication (MFA): MFA adds an extra layer of security by requiring more than one form of verification before granting access. This significantly reduces the risk of unauthorized access even if login credentials are compromised.

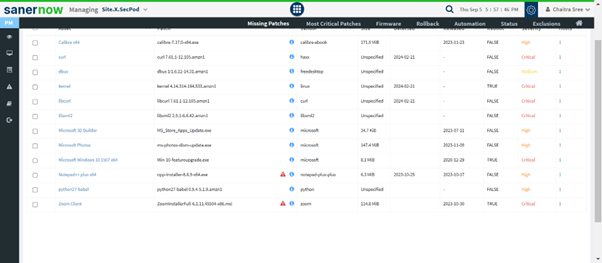

- Regularly Update and Patch Devices: Keeping software and devices up-to-date is crucial for protecting against potential risks. Regular updates and patches address security flaws that cybercriminals could exploit.

- Conduct Employee Training: Employees are often the first line of defense against cyber threats. Regular training on recognizing phishing attempts, safe browsing practices, and data protection can greatly reduce the risk of security breaches.

- Utilize Encryption: Encrypting sensitive data ensures that even if it is intercepted, it remains unreadable without the proper decryption key. Encryption should be used for data at rest and in transit to protect against unauthorized access.

- Perform Regular Security Audits: Regular security audits assess the effectiveness of current security measures and identify areas for improvement. These audits help organizations stay ahead of emerging threats and ensure compliance with regulatory standards.

- Develop an Incident Response Plan: Having a well-defined incident response plan ensures that your enterprise can quickly and efficiently respond to a security breach.

How does SanerNow help in Protecting Financial Enterprises?

- Detect and Remediate Security Risks beyond CVEs: SanerNow continuously detects vulnerabilities, misconfigurations, anomalies, exposures, and other security risks. With SanerNow, you can not only detect risks but also instantly patch them and reduce the attack surface.

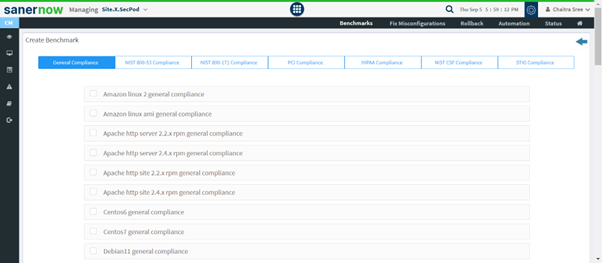

- Adhere and Comply with Regulatory Benchmarks: With SanerNow compliance management, you can be compliant with just a click of a button. It supports all major benchmarks, such as PCI-DSS, HIPAA, NIST, and STIG.

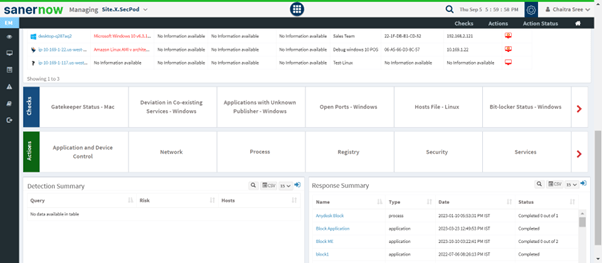

- Secure Endpoints with 100+ security controls: Implement security controls beyond patching to mitigate security risks, eliminate outliers, perform system tune-ups, and strengthen your security posture in one console.

Conclusion

According to reports, the second most cyberattacked industry is the financial sector. As mentioned, with an enormous number of cyberattacks and also heavily reliant on technology for transactions, its a necessity to protect them.

There are tools such as SanerNow that eliminates risks such as anomalies, exposures,vulnerabilities and misconfiguration instantly. It is also known for its industry fastest 5 in scans and wide range of third-party application support.