We have a love-hate relationship with debt. But why am I talking about debt in a vulnerability management blog? Vulnerability debt is a new concept that has gained traction recently, and it is a great way to understand the impact vulnerabilities and security risks have on your network. So, lets dig deeper into what it is, the different factors that comprise it and understand its impact with a case study.

What is Vulnerability Debt?

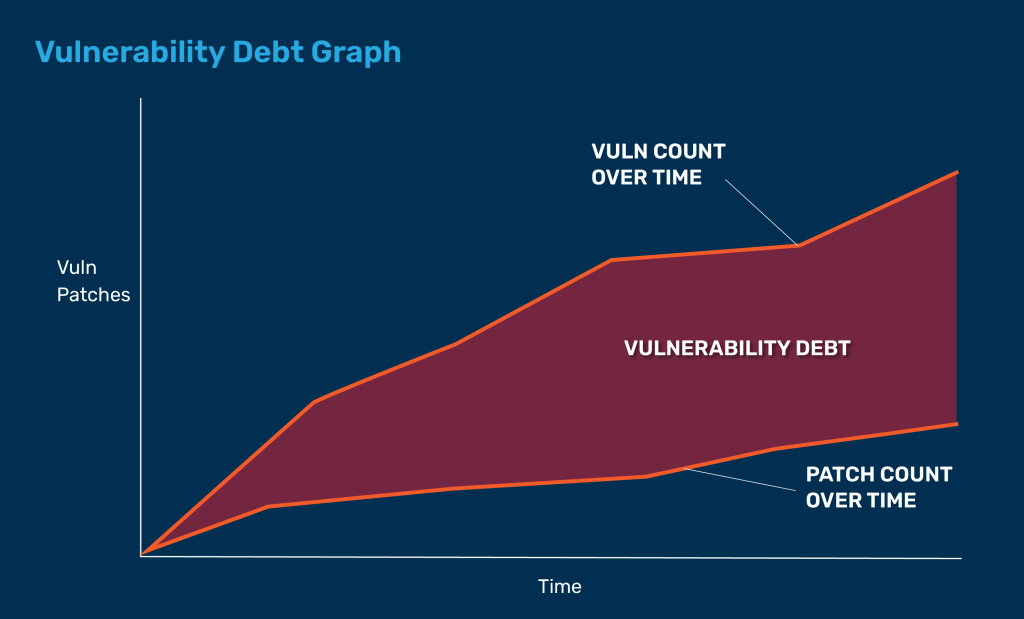

In simple terms, vulnerability debt is the number of security risks that accumulate over time. We all know the typical scenario of thousands of risks detected in a network and the IT Security teams struggling to patch these risks. Some get patched based on a prioritization method, and the rest are forgotten and accumulate into a large number. This accumulation is what we call vulnerability debt, and it can be dangerous if left unmanaged.

Here’s a visual representation of vulnerability debt.

Factors that Make Up Vulnerability Debt

- Delayed Patching: The most obvious of the lot, debt accumulates due to a long delay between the availability of the patch and its application. This delay could be due to operational issues, potential downtime of your devices, lack of availability of patches themselves, and so on.

- Ineffective Vulnerability Management: A general challenge that most enterprises face, ineffectively managing risks is a key contributor to your vulnerability debt. The culprits in this case are multiple ineffective tools, no proper process set in place, and the overall efforts needed to actually do vulnerability management!

- Resource Constraints: Managing and reducing vulns is not easy. Most enterprises might just not have enough people in their security and IT teams to handle this massive rise in risks. Adding to that, a lack of proper automation, limiting tools, and security budgets will lead to delays in patching, which in turn leads to an increase in your debt!

- Complex and Difficult-to-manage IT: The IT network of now and the network you managed 10 years ago is drastically different! Remote devices, OT and IoT devices, multi-OS devices, and servers are part and parcel of your network now. This complexity has led to an increased number of risks, and the bottom line is that it’s just difficult to manage these networks!

Dangers of Vulnerability Debt

Now you know what vulnerability debt is and what it is made up of. So, what’s the impact? Let’s take a look at the potential ramifications:

- Higher Chances of Cyberattacks: Higher debt means a higher number of risks that a potential attacker can leverage and exploit!

- Increased Cost over Time: Every debt has interest, and the longer you let risks in your network, the more the cost and efforts needed to actually remediate them keep increasing. And if a cyberattack occurs, the cost and impact is immense.

- Compliance Non-adherence: While vulnerability debt is not an outright measure in compliance regulations, failing to reduce it often falls in line with the regulatory recommendations.

- Reputational & Operational Impact: Vulnerability debt leads to cyberattacks, and cyberattacks can devastate your enterprise. Your operations are impacted, and the reputational impact can’t be measured at all

Understanding Debt: A Case Study

The ramifications vulnerability debt can have on your network is immense. Here’s a real-life example of an enterprise that accumulated too much vulnerability debt and had to pay the price.

The enterprise in question is a mid-sized financial company. Here’s a timeline of how the vulnerability debt changed over the year for the enterprise and, in the end, led to a cyberattack that crippled them.

Day 0: Vulnerability scans set up and the initial scans had the number of vulnerabilities and risks in the network at few thousands.

Day 100: Based on basic prioritization, some high-risk vulnerabilities are patched, but a large amount of vulnerabilities are still unpatched.

Day 200: The trend continues, with a vulnerability debt accumulating more and more with each passing day.

Day 284: The day of the cyber-attack. Vulnerability debt is too much to handle, and the enterprise is hit with a cyberattack from one of the risks left unpatched.

So, what were the consequences, you ask? Hefty fines, loss of sensitive data, and reduced customer reputation!

Conclusion

Vulnerability debt will be dangerous if left unchecked. The consequences are heavy, and its impact is immense. But with a solid vulnerability management strategy paired with a capable vulnerability management tool, you can reduce your vulnerability debt and avoid the ramifications!

SanerNow is an advanced vulnerability and exposure management tool that leverages its natively integrated technology to reduce vulnerability debt. It automatically detects risks, prioritizes them based on CVSS or your custom instructions, and fixes them. Check it out for yourself here!